KARACHI:

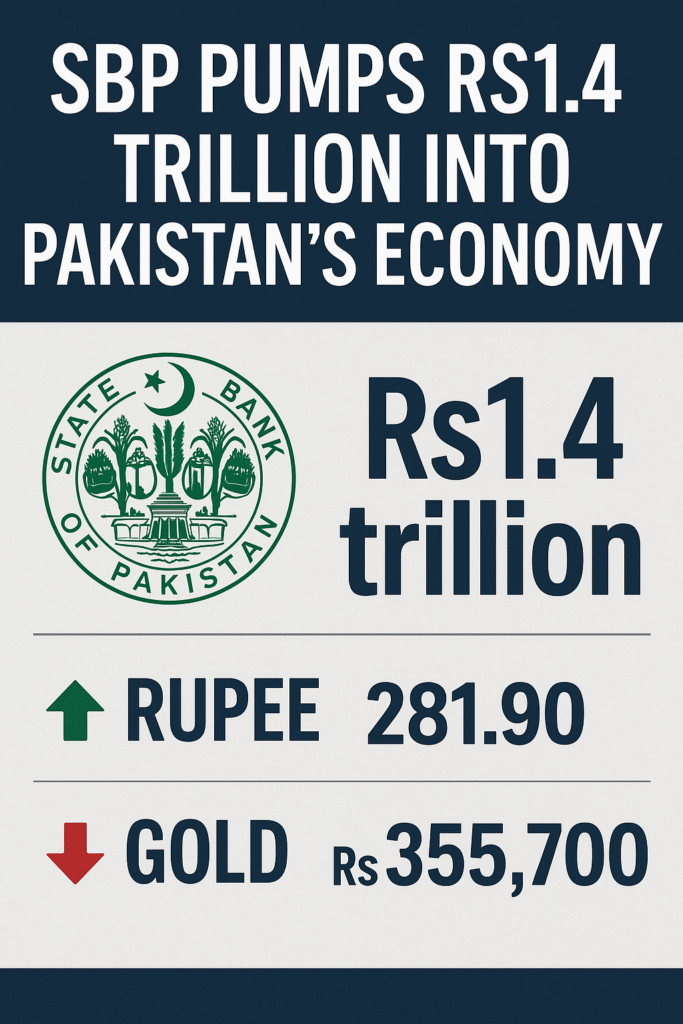

The State Bank of Pakistan (SBP) injected an unprecedented Rs1.4 trillion into the financial system on Friday through dual open market operations (OMO), utilizing both conventional reverse repo and Shariah-compliant Mudarabah instruments to meet surging liquidity demands.

In the conventional OMO, the SBP injected Rs1.037 trillion against offers of Rs1.150 trillion, accepting Rs76 billion at 11.06% (7-day) and Rs962 billion at 11.04% (13-day) tenors. Additionally, Rs363 billion was injected via Mudarabah-based operations, with Rs241 billion at 11.14% (7-day) and Rs122 billion at 11.13% (13-day).

Meanwhile, the Pakistani rupee strengthened for the 11th consecutive session, closing at 281.90 per USD, marking a slight 0.01% appreciation and showing 0.66% gains in FY25. Analysts attribute this rise to stable forex reserves and robust remittance inflows.

On the commodities front, gold prices in Pakistan dipped by Rs1,500 per tola to Rs355,700, despite international gold prices rebounding to $3,362.53 per ounce following US Fed Chair Jerome Powell’s remarks hinting at a September interest rate cut. Market analysts predict that gold may target $3,450 if it breaks the $3,400 resistance level.

This financial shift highlights SBP’s proactive monetary measures, rupee’s consistent performance, and global market dynamics affecting Pakistan’s gold market.